LGBTQ+ Economics & Financial Capability

Service design ecosystem to empower queer personal finance.

- Organization: Student @ Lesley University

- Duration (8 months):

- Team:

- Manny, Researcher + Designer

- Skills:

- Service Design

- UX Research

- Tools:

- Figma

- Miro

- Notion

My senior capstone project at Lesley University built upon my advocacy for LGBTQ+ issues and interests in personal finance.

- Personal finance is something I’ve been studying and practicing since 2017.

- In 2020, I launched a financial literacy blog called nuOpulence where I used queer culture and creative writing to make educational articles about financial topics.

- In 2021, I used my capstone as an opportunity to re-visit my initial idea and gather design research to develop better solutions that explicitly support queer people through their personal finance journey.

I hypothesized that the LGBTQ+ community faces U N I Q U E challenges…

- American society at large lacks widespread financial education and culture. This disproportionately affects LGBTQ+ people, which further perpetuates socioeconomic disparities they experience.

- For researchers and policy makers, there is a lack of high quality data on LGBTQ+ people making it difficult to identify these problems and find solutions.

I tested my assumptions with a mix of 60 survey responses, 6 interviews and literature review.

- LGBTQ people often live in higher cost of living areas, this tends to correlate with more legal protections compared to lower cost of living areas.

- Transgender people are 4x more likely to make less than $10,000 a year than the general population.

- 32% of LGBTQ student borrowers in 2018 reported discrimination from a financial professional.

- 51% of LGBTQ seniors are concerned about having enough money to live on during retirement compared to 36% cis/het peers.

The Insight

- Financial literacy means almost nothing without financial capability

Financial capability is the ability of consumers to use the acquired financial literacy to make better informed decisions about managing their finances… it encompasses the knowledge (literacy), attitudes, skills, and behaviors of consumers regarding understanding, selecting , and using financial services and the ability to access financial services that fit their needs. — World Bank

The Idea

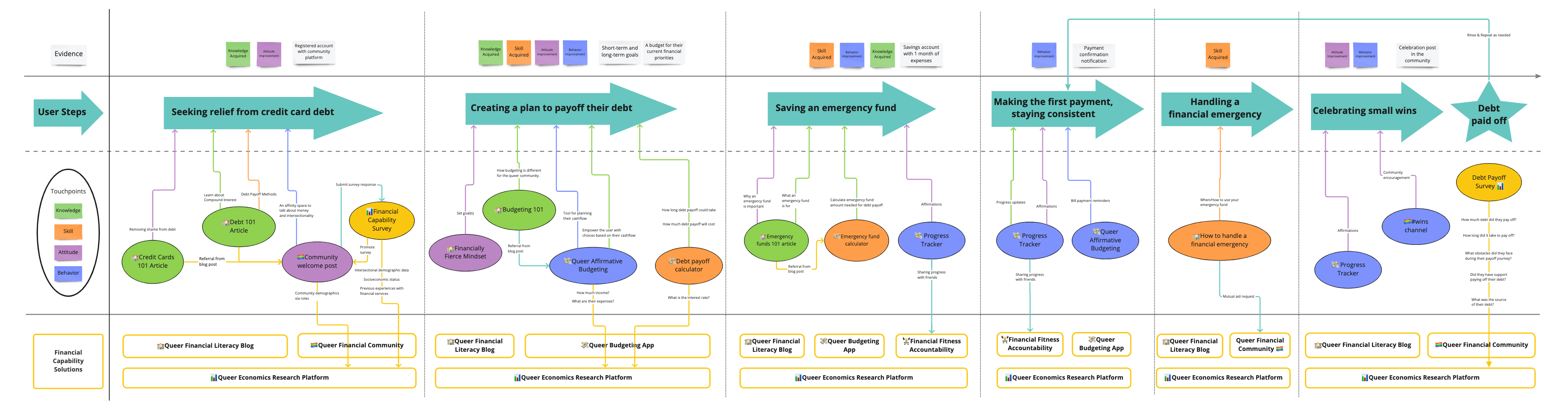

- A service design blueprint that built upon my existing financial literacy blog with touchpoints that addressed capability in addition to literacy.

- One of the core touch-points of my service design is a Queer Financial Community. An affinity space that could exist on a platform like Facebook, Slack or Discord to talk openly about money and learn from each others experiences.

What I Learned

- My survey initially excluded middle-eastern and north African (MENA) participants in my racial/ethnicity demographic questions. This was something I fixed quickly and learned that the U.S. census bureau had a problem with as well.

- Pay attention to research participants behavior and body language during an interview, especially with card sorting activities. Asking about swiftness or hesitation in a participants answer or decision can lead to interesting stories and insights.